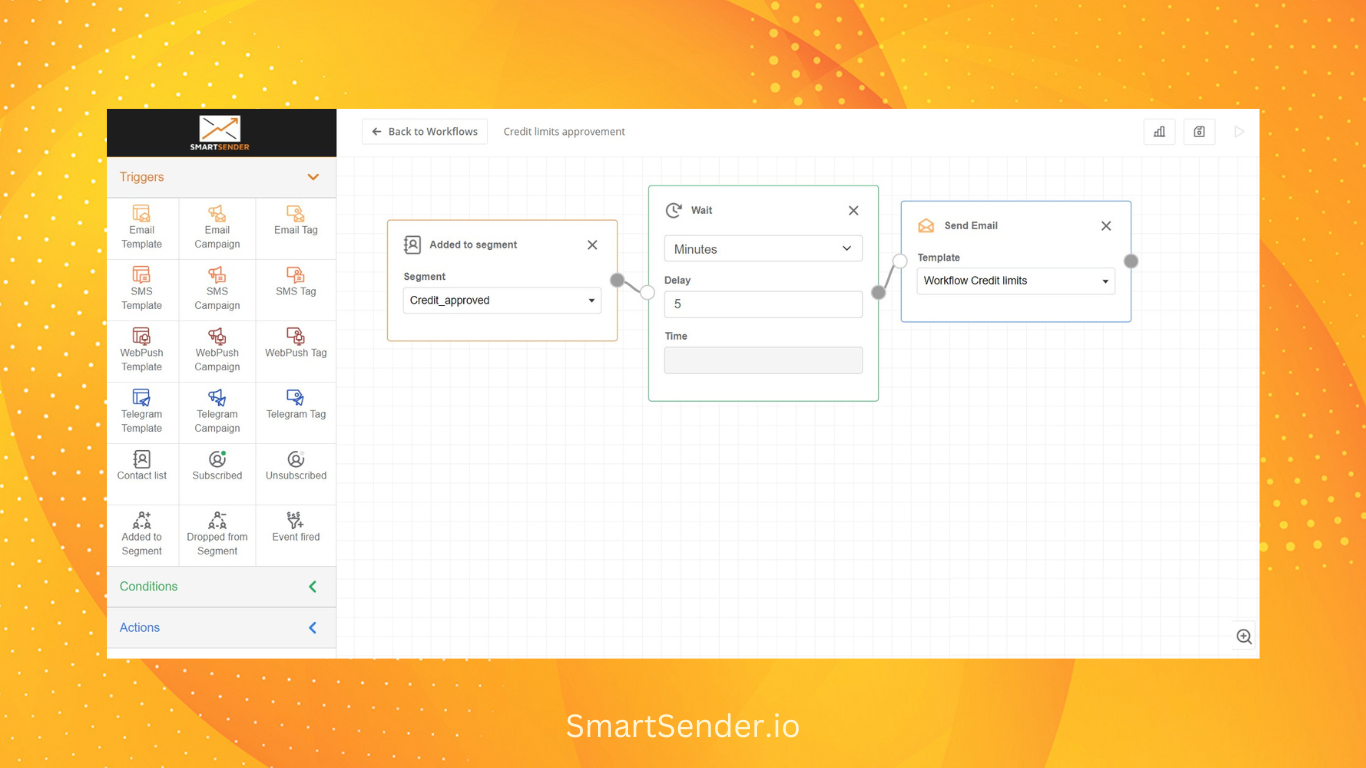

Credit limits approvement

Preview the Workflow

Author:

Categories:

Tools:

Publication date:

Plan:

Description:

According to a study by Experian, 62% of consumers say they would be more likely to use a credit card if they received a credit limit increase.

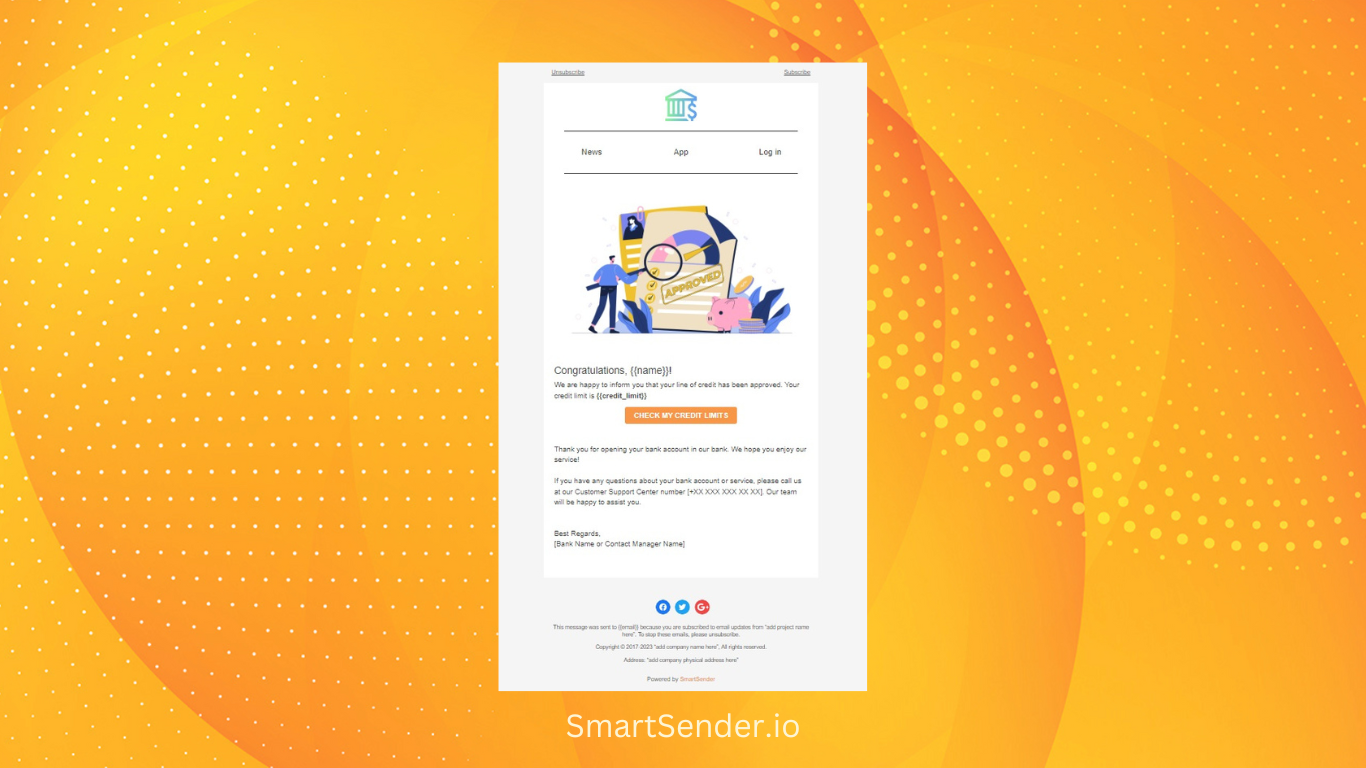

Prompt communication through credit approval emails informs customers about their credit status, enhancing transparency and trust. Customers appreciate timely updates and are likelier to choose banks that communicate clearly and efficiently.

Credit approval emails automate and streamline the credit decision process. They enable banks to make faster and more accurate lending decisions, reducing the time and effort required for manual reviews.

Automating the credit approval process with emails reduces the need for manual paperwork, phone calls, and in-person interactions. This leads to significant cost savings for banks regarding personnel and resources.

The banking industry is a clear winner in email deliverability. Banks, on average, have a 97% inbox placement rate. You could use this workflow to inform your clients about credit limit approvement. The client will receive an email with information about credit limits, support contact, and other information you decide to add if necessary.